The Indian real estate sector has come a long way since the economic fluctuations and rapid lifestyle changes of the past decade. As the country progresses towards 2026, it is witnessing a unique confluence of technological advancements, infrastructure development, and favorable regulatory reforms. These factors are not only boosting the real estate market but are also reshaping how people live, work, and invest in properties. As 2026 approaches, it presents a promising opportunity for real estate investors in India.

This blog dives deep into the major real estate trends shaping the market in 2026, and how investors can leverage these trends for optimal returns. If you’ve been wondering whether investing in real estate in India in 2026 is a good idea, the answer is a resounding “yes.” Let’s explore why.

Key Reasons to Invest in Real Estate in India

The year 2026 stands out as a pivotal point for the Indian real estate market due to several key developments that have been building momentum in recent years. Here are the primary reasons why 2026 is a significant year for property investment in India:

1. Infrastructure Development

India’s infrastructure boom is one of the strongest driving forces behind its real estate market’s growth. Metro cities like Bengaluru, Delhi, and Mumbai are witnessing massive expansions, improving connectivity through expressways, metro networks, and regional transport links. At the same time, the ongoing Smart City projects are transforming urban mobility, making once underserved areas highly attractive for investment. These infrastructural improvements are fueling the demand for both residential and commercial properties, presenting a great opportunity for investors.

2. Regulatory Reforms and Increased Transparency

One of the biggest advantages for property buyers in India has been the implementation of regulatory reforms like the Real Estate (Regulation and Development) Act (RERA). By enforcing stricter transparency and accountability from developers, RERA has ensured that buyers are protected from unscrupulous practices. Additionally, the digitalization of land records is eliminating ownership ambiguities, further boosting investor confidence. With these reforms in place, India’s real estate market in 2026 is poised to be much more secure and transparent.

3. Technological Advancements

Technology is playing a key role in transforming India’s real estate sector. From AI-driven property tools to virtual property tours, technology is making property transactions faster, more efficient, and transparent. Blockchain-based systems are being adopted to ensure secure transactions, while AI-powered analytics are helping investors make data-driven decisions. With a more predictable interest rate cycle, home loan volatility is also expected to stabilize, further making real estate investments more appealing.

4. Growing Interest from NRIs

Non-Resident Indians (NRIs) are expected to significantly increase their investment in India’s real estate sector, especially those from regions like the Middle East, the US, and Europe. With the increasing disposable income of younger generations (Millennials and Gen Z), combined with the rise of hybrid work models, NRIs are keen to invest in Indian real estate as a long-term financial strategy.

5. Hybrid Work Models and Changing Lifestyles

Post-pandemic, the hybrid work model has reshaped the way people live and work. This shift is influencing the demand for different types of properties, such as homes with larger workspaces and second homes in serene locations. The increased flexibility in work has led to higher disposable incomes, which in turn is driving demand for high-end real estate in India.

Key Real Estate Trends to Watch in India in 2026

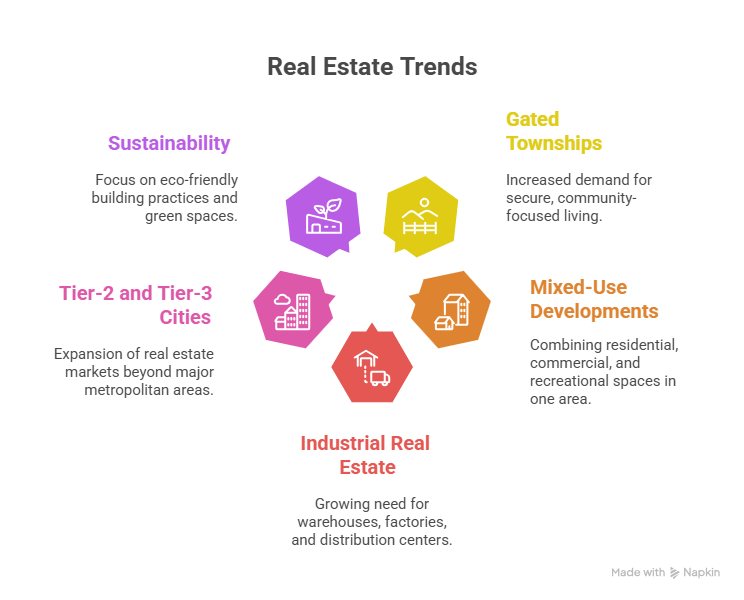

Several prominent real estate trends are expected to dominate the Indian market in 2026. Understanding these trends can help investors make informed decisions and identify lucrative opportunities:

1. Demand for Gated Townships and Integrated Living

With increasing concerns about safety, security, and community living, gated townships are becoming a popular choice for homeowners. These townships offer integrated amenities like schools, healthcare facilities, parks, and shopping centers, which add value to the overall living experience. Investors can expect strong demand in this category, especially as more people seek self-contained communities.

2. Mixed-Use Developments

The concept of mixed-use developments is gaining popularity, particularly in metro cities. These developments combine residential, commercial, and recreational spaces within the same complex, providing residents with the convenience of working, shopping, and living in close proximity. As urban spaces become more crowded, mixed-use developments will be a go-to investment option for those seeking modern lifestyles.

3. Surge in Demand for Industrial Real Estate

The rise of e-commerce in India, along with the country’s growing importance as an alternative manufacturing hub to China, is driving the demand for industrial real estate. Logistics parks and Grade-A warehouses are now essential to support the growing e-commerce industry. This trend will continue in 2026, making industrial real estate a hot investment option.

4. The Rise of Tier-2 and Tier-3 Cities

India’s Tier-2 and Tier-3 cities are emerging as key players in the real estate market. Cities like Jaipur, Surat, Coimbatore, and Nagpur are witnessing rapid infrastructure development and job creation, driven by AI parks, tech hubs, and industrial zones. These cities offer better affordability and a higher return on investment compared to the saturated metro cities, making them ideal for first-time buyers and long-term investors.

5. Sustainability in Real Estate

As environmental concerns rise, sustainability has become a key factor influencing property investments. Developers are increasingly adopting green construction practices and incorporating energy-efficient designs, rainwater harvesting systems, and electric vehicle (EV) charging stations in their projects. Buyers and investors are now prioritizing eco-friendly homes that adhere to Environmental, Social, and Governance (ESG) norms.

Metro Cities to Watch in 2026

While Tier-2 cities are growing rapidly, metro cities continue to be a prime focus for property investors in 2026. Key hotspots to look out for include:

- Bengaluru: Whitefield, Sarjapur Road, and ORR continue to be strong performers due to the expansion of the IT industry and improved infrastructure.

- Hyderabad: The Financial District and Kokapet offer great potential for appreciation, thanks to strong job growth and planned infrastructure.

- Chennai: Areas like OMR and Sholinganallur remain top choices due to the ongoing IT boom.

- Pune: Kharadi and Hinjewadi are thriving localities, supported by large IT parks and improved connectivity.

- NCR: Noida and Gurgaon remain attractive due to strong rental demand and premium developments.

Expected Price Movements in 2026

The combination of rising construction costs, land shortages in prime areas, and growing demand in business hubs will drive property prices up in 2026. However, the increase in prices will vary across regions. Metro suburbs and Tier-2 cities are expected to see moderate to stable price appreciation. Investors can still find opportunities in emerging markets before prices surge.

New Investment Models in Real Estate

With the real estate market evolving, new investment models are gaining popularity. Fractional ownership allows investors to buy a stake in high-value commercial properties, making it easier to invest in premium assets. Real Estate Investment Trusts (REITs) are expanding beyond commercial properties to include retail and warehousing spaces. Tokenized real estate, although in its early stages, is gaining traction due to its transparency and liquidity.

Conclusion:

2026 presents a unique opportunity for real estate investment in India. With advancements in infrastructure, regulatory clarity, technology adoption, and growing interest from NRIs, the market is set for substantial growth. Investors can expect steady returns from both residential and commercial properties, particularly in emerging Tier-2 cities and metro suburbs.

By understanding the trends and acting early, investors can maximize their returns and secure long-term growth in India’s real estate market. With the right investment strategy, 2026 is set to be a lucrative year for property buyers and investors.

To stay updated on the latest real estate trends, keep reading Inframantra blogs and articles. To explore the best properties in Gurgaon, Delhi, Noida, Pune, and Jaipur, check out Inframantra website- one of the best real estate consultancy firms in Gurgaon, or directly connect with an Inframantra property expert.

✍️ Written By: INFRAMANTRA

.webp)